Do environmental taxes corrupt governments?

- Nov 13, 2024

- 2 min read

Updated: Dec 24, 2024

Latest research article on environmental taxation and corruption by Dr. Nguyen Phuc Canh, HAPRI's Senior Researcher. The study examines the impact of environmental taxes on corruption across 111 countries from 2002-2020.

The research investigates four types of environmental taxes (carbon, energy, resources, and transport) and their effects on corruption indices, providing crucial insights into whether environmental tax implementation leads to increased government corruption. Using comprehensive data analysis, the study reveals that environmental taxes generally contribute to better anti-corruption outcomes, particularly in high-income countries.

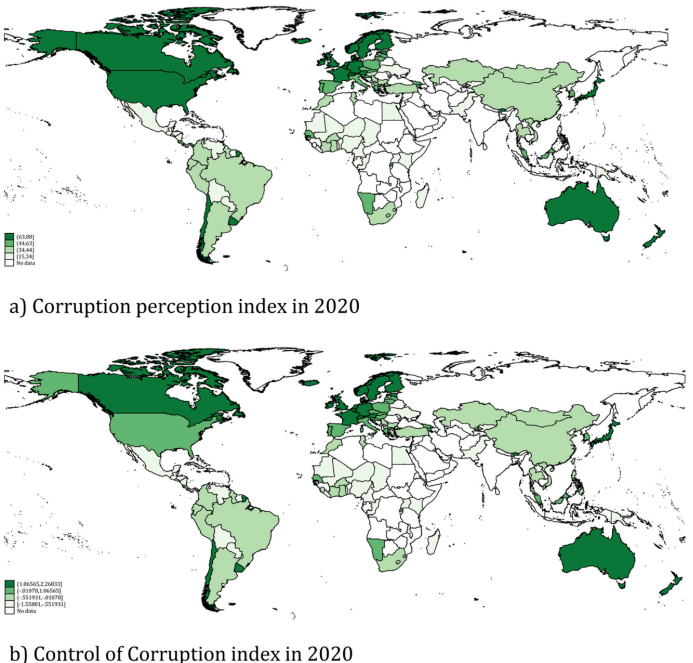

Global corruption in 2020

The findings demonstrate complex relationships between environmental taxation and corruption levels. In high-income countries, energy taxes show positive effects on anti-corruption measures, while pollution taxes display negative effects. Conversely, in low and middle-income countries, energy taxes can potentially increase corruption, highlighting the importance of energy security before implementing such taxes.

The study identifies two key channels through which environmental taxes affect corruption: government expenditure and taxation on income, profits, and capital gains. The research suggests that complementing environmental taxes with reductions in other taxes could help mitigate corrupt behaviors, particularly in high-income countries with polluting industries.

Policy implications emphasize the need for careful implementation of environmental taxes based on country income levels. For low and middle-income countries, ensuring energy security before implementing energy taxes is crucial. In high-income countries, considering simultaneous reductions in income and capital gains taxes when implementing pollution taxes could help minimize corruption risks.

The research provides valuable insights for policymakers designing environmental tax policies, suggesting that their effectiveness in reducing corruption varies significantly based on country characteristics and implementation strategies. The findings underscore the importance of tailoring environmental tax policies to specific country contexts while considering their potential impacts on institutional frameworks.

This comprehensive study offers new perspectives on the relationship between environmental taxation and corruption, contributing to our understanding of how environmental policies can be designed to promote both environmental sustainability and institutional integrity.

KEYWORDS:

Tax

Environmental Tax

Corruption

Government

Environment

Citation:

Nguyen, C. P., Doytch, et al (2024), "Do environmental taxes corrupt governments?", Economic Systems, pp. 101268, DOI: 10.1016/j.ecosys.2024.101268